Margin is an extension of credit using eligible securities as collateral. You can use your margin loan to buy securities or withdraw funds for other purposes. Once an account is approved for margin, it is subject to requirements at the security, brokerage and industry level. Margin accounts typically have a minimum equity requirement of $2,000.. Regulation T call: This type of call refers to the requirements needed to begin a margin trade and can occur when an investor makes a transaction in a margin account without meeting the initial 50.

What Is Margin Call? FXTM Learn Forex in 60 Seconds YouTube

Margin Call en streaming et téléchargement

Marge Trading en Margin Trading in Forex en CFD

Margin Call What It Is, How It Works & How To Avoid It Seeking Alpha

Definitie Margin Call

Margin Call (2011) Posters — The Movie Database (TMDB)

Margin Call Price Formula + Calculator

:max_bytes(150000):strip_icc()/Margincall-1b75e4a92ac441fd9ca5676f5494a70b.jpg)

Margin Call What It Is and How to Meet One with Examples

How Margin Calls Work in Cryptocurrency Lending

Forex Leverage And Margin Explained Babypips Com

Margin Call Meaning Formula, Calculator, Risk, Management

Apa Itu Margin Call? Artikel Forex

Trading Scenario Margin Call Level at 100 and No Separate Stop Out Level Signals Leader

Margin Call (2011) Poster 1 Trailer Addict

Margin Call (2011) Posters — The Movie Database (TMDB)

Margin Call wat is het? Beleggingsinstituut.nl

Margin Call Explained (With an Example) SurgeTrader

What is Margin Call Meaning, Explanation, and Examples

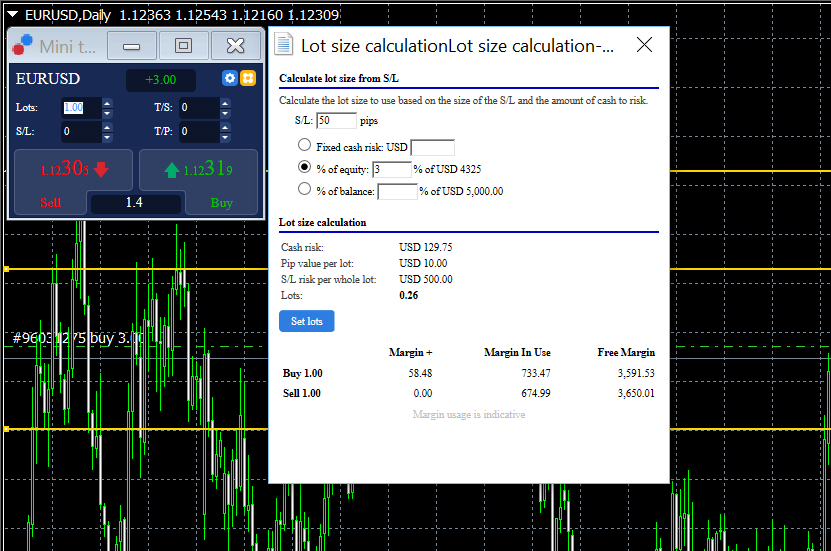

Margin call currency trading forex demo metatrader

Margin calls betekenis Wat is een margin call en hoe vermijd je het?

This will help you avoid a margin call by ensuring that you maintain a sufficient level of equity in your account. Monitor your account: Regularly check your account balance and the value of your.. The formula for calculating a margin call is as follows: Margin Call = (Current Market Value of Position – (Initial Margin * Position Size)) /. (1 – Margin Requirement) The “Current Market Value of Position” refers to the current market price of the asset multiplied by the size of the trader’s position. The “Initial Margin” is the percentage of.